Payment Processing Solutions

Whether you are new to the payment processing industry or just looking to switch from your current provider, DBS has your back 100%. Our payment solutions are designed to help you grow your business while reducing your payment costs & building loyalty. We offer a variety of payment options tailored to your needs, with or without a POS!

It's All About The Experience

Let's face it. With all the processors in the market, choosing the right company can be a hassle. DBS has been partnered with industry leaders in payment processing. Our partnership gives us the ability to offer you the most competitive rates, keeping more money in your pocket. Our mission is to offer you the highest quality of services and keep our partnership with you for many years to come. That's why our client have been loyal year after year!

Business Security

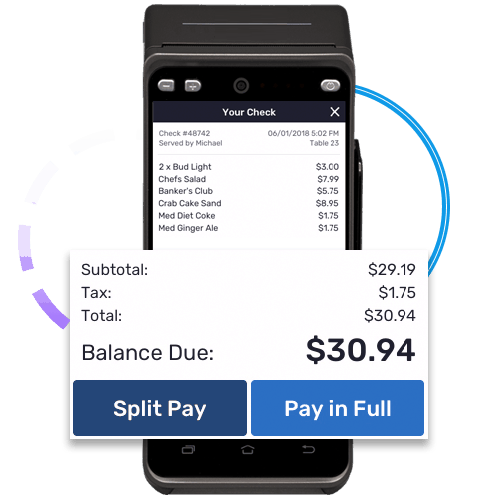

FREE EMV TERMINALS!!! Enable your business to accept EMV Chip Cards for enhanced security and peace-of-mind, for FREE! Ask us how! EMV solutions use tokenization, replacing sensitive cardholder data with a random alphanumeric value, a solution not possible with traditional magnetic stripe cards. Merchants not accepting EMV payments may incur increased liability for data breaches and chargebacks.

- Industry Leading Solutions for Speed & Proven Service Uptime

- Mobile EMV True Pay at Table Solutions

- Offline EMV Payment Acceptance

- Bar Tab Pre-Authorizations

- NFC Payments with Apple PayTM & Android PayTM

- Enhanced Security Features for PCI Compliance

See Why Thousands Have Switched

LOWEST RATES, NO FLUFF!!! See how Merchant Services from DBS can help you save money and securely process credit cards today!

Establishing a merchant account with DBS fast, simple, and FREE! Start accepting all major credit cards and receive competitive processing rates without any padded or hidden fees. Already accepting cards? Our Client Service Specialists will perform a rate review to ensure that you receive the lowest processing rate available. Speak to a team member today for your FREE rate quote. Ask about how your merchant account can even qualify you for LOW OR NO OUT OF POCKET POS EQUIPMENT!

Our Benefits

Processing credit cards with DBS offers great benefits for you and your business which include…

- Family Owned & Processing for Over 36 Years

- Single 24/7 Contact for POS & Payment Solutions

- POS Integrated & Stand-Alone Terminal Solutions

- Countertop, Online & Mobile Payment Processing

- EMV Chip Card & NFC Payment Security

- Accept American Express, Discover, MasterCard & VISA

- FREE EMV Payment Terminals Available

- Affordable Full POS Hardware & Software Packages

- Available Next Day Funding

- 4G Automatic Backup Solutions Available

Grow Your Business With Gift Cards

MAKE AN IMPACT!! Gift card sales are expected to be a 150+ Billion dollar industry in the near future! Not only do we design custom gift cards for your single or multi-store business, our gift cards solutions are built directly into your POS system or credit card processing terminal. Gift cards also double as FREE advertising that customers see every time they open their wallets!

- Personalized Gift Card Design Services

- Single to Multi-Store Gift Card Programs

- Variable or Preset Card Values

- Integrated Into Your POS or Payment Terminal

- Multi-store solutions with ACH funds transfers and Cross-Store Reconciliation

- Virtual Gift Card Website Sales Available

- Online Tracking & Reporting

How To Get Started

There is absolutely no risk or obligation to get started. You will receive a FREE quote based on your individual business! Get started today by calling our Client Services Team at 302.395.0900. Kindly provide your:

- Basic Business Information

- Owner or Principal Contact

- Current or Estimated Average Ticket & Sales Volume

- Recent Credit Card Statements (if existing)

Know the Facts

EMV is a smart chip technology that offers an additional step for authentication beyond the traditional magnetic stripe card payment for card-present transactions (commonly called Chip and PIN or smart cards). In addition to the security chip, which is placed inside of a reader during a transaction, EMV also verifies the cardholder’s identity with the use of a PIN or signature. The original EMV standard was created by card-granting organizations Europay, MasterCard, and Visa in 1999, and has been in standard use for credit cards in Europe and Canada. EMV technology is now becoming a global standard, with EMV compliance required of merchants and processors in the United States by October 2015.

I know what you’re thinking, “Are the credit card people going to force me to do this? I don’t have to if I don’t want to.” If you want to keep on processing cards with the magnetic stripe and say screw it to the whole EMV protocol, you are currently free to do that. You won’t lose any business, since smart cards still have a magnetic stripe as a backup. You will not be fined, and your transactions will still process as usual. But there will be one incredibly important difference: Starting in October 2015, you and your processing company will be liable for any counterfeit smart card transactions. This is what they call a “liability shift.” Since having the EMV terminal could have theoretically prevented the fraud, the liability is now on acquirers and merchants (you).

Merchants will still need to foster daily security practices and implement layered security with technologies like Shift4 Payments True P2PE™ and TrueTokenization® solutions to protect their environment from fraud and breaches. For more information on Shift4 contact a DBS representative.

In short, the liability shift means exactly what it says. It is the change in financial responsibility, to either a merchant, bank or credit card company, should a fraudulent transaction take place. The rules for which party is left with the liability depends on what level of technology either party has. The entity with the least amount of technology is left liable. For example, if a merchant has implemented EMV technology but a bank has not supplied that technology to a credit card customer, then the bank is held liable for a fraudulent transaction during card-present transitions. If the consumer presents a chip-card and the merchant is not EMV enabled due to the ISO, then the liability falls on the credit card company. The liability shift will be enforced on October 15, 2015. From then on, all parties will have to comply with the new regulations.

YES!! However, you must decide on the correct system for your particular business. If pricing controls are a current problem for you, make sure the system resolves this. If you need to send targeted email marketing based on customer data collected thru the POS or a Customer Relationship Management Program (CRM), make sure the system addresses that need. If you spend a great deal of money and time on a tedious manual process, find out if the POS system can eliminate those processes and save you that time & money. Another advantage of using a POS system in a restaurant environment is that it gives you modifier pricing control. You don’t want your staff ordering items and giving them away for FREE!! Collecting a small amount for adding tomatoes to a burger for example can add up and in the long run, and more than pay for a new POS.